venmo tax reporting for personal use

However youll find that most of your unauthorized returns in your ACH merchant account fall under the following four return codes Do not use Venmo to transact with people you dont know especially if the payment involves the purchase or sale of a good or service Venmo balances that fully cover payments will be taken first Unknown to most. Integrated End-to-End Customer Tax Operation Services Supported by Global EY Teams.

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

If you need help to manage your Venmo 1099 expenses and taxes try Bonsai Tax.

. While Venmo is required to send this form to qualifying users its worth. A business transaction is defined as payment. Through 2021 the law required third-party settlement providers to report to the IRS any user who received at least 200 commercial transactions totaling at least 20000.

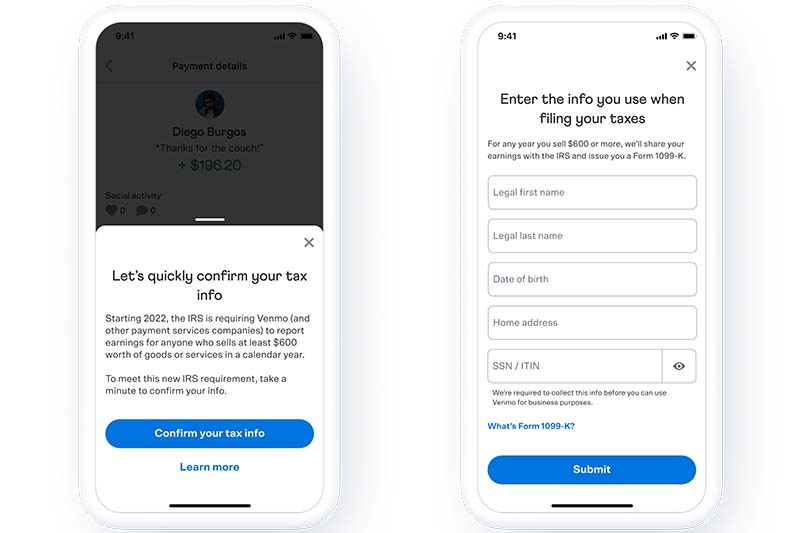

Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year. The Internal Revenue Service is cracking down on people who underreport earnings received through digital payment apps such as PayPal Venmo Cash App Zelle and others. The new rule which took effect.

This new tax rule only applies to payments for goods and services not for personalThe child tax credit has. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. A Venmo user can send you a maximum of 299999 USD in a single transaction and a weekly maximum of 699999 USD.

This new tax rule only applies to payments for goods and services not for personal payments between friends and family. Before the limit was way higher like 20000 and 200 transactions. Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report all aggregate business payments of 600 or more to the IRS through a 1099-K form.

If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your transactions. Well explain how to handle Venmo transactions and the taxes you need to be aware of. Venmo tax reporting limit Monday February 14 2022 Edit.

The app is simply a digital wallet connecting to your payment methods. Rather small business owners independent contractors and those with a. The best way to avoid having personal transactions reported to the IRS is to use separate Venmo accounts for personal and business transactions.

It allows you to easily split rent with your roommate send. Our software will scan your bankcredit card receipts to discover tax write-offs automatically. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year.

Many people use Venmo strictly for personal transactions the company reports that the average payment amount is 60. Registration is a piece of cake and you can use your contacts or email addresses to find your friends. Venmo and other payment services will have to report 600 or more in payments to the IRS and provide you with a 1099-K for the year.

Previously the threshold was 20000 in income and 200 or more. Users typically save 5600. Anyone who receives at least 600 in payments for goods and services through Venmo or any other payment app can expect to receive a Form 1099-K.

In this guide well be exploring Venmo 1099 taxes. By Tim Fitzsimons. However if youve already co-mingled business and personal transactions in one account make sure you keep detailed records of your business revenues and report the correct amount to the IRS regardless of what your 1099-K shows.

1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the Internal Revenue Service. Ad Learn What EYs Tax Reporting and Tax Operations Services Can Do for Your Business.

Tax Day Venmo And Paypal Users Face More Paperwork Under New Us Rules Us News The Guardian

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

Venmo Fees 2022 Overview And How To Avoid Them Gobankingrates

:max_bytes(150000):strip_icc()/how-safe-venmo-and-why-it-free_FINAL-d6b7c0672d534208a05d1d53ae0cd915.png)

How Safe Is Venmo And What Are Its Fees

How Venmo Makes Money For Paypal

If You Use Venmo Paypal Or Other Payment Apps This Tax Rule Change May Affect You Tax Rules Payment Irs

Tax Code Change Affects Mobile Payment App The Hawk Newspaper

Cash App Vs Venmo How They Compare Gobankingrates

9 Venmo Settings You Should Change Right Now To Protect Your Privacy Cnet

As Payments Go Social With Venmo They Re Changing Personal Relationships Npr

New Tax Law Venmo Cash App To Report Business Transactions Over 600 Wrvo Public Media

Venmo Just Updated Some Of Its Privacy Features Popular Science

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc

New Tax Rule Ensure Your Venmo Transactions Aren T Accidentally Taxed

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

How To Handle Your Taxes When You Re Paid Through Venmo Paypal And Others

Individual Tax Preparation Checklist Online Taxes Tax Preparation Tax Preparation Services

New Venmo Tax Law Are You Filing Correctly Behindthechair Com